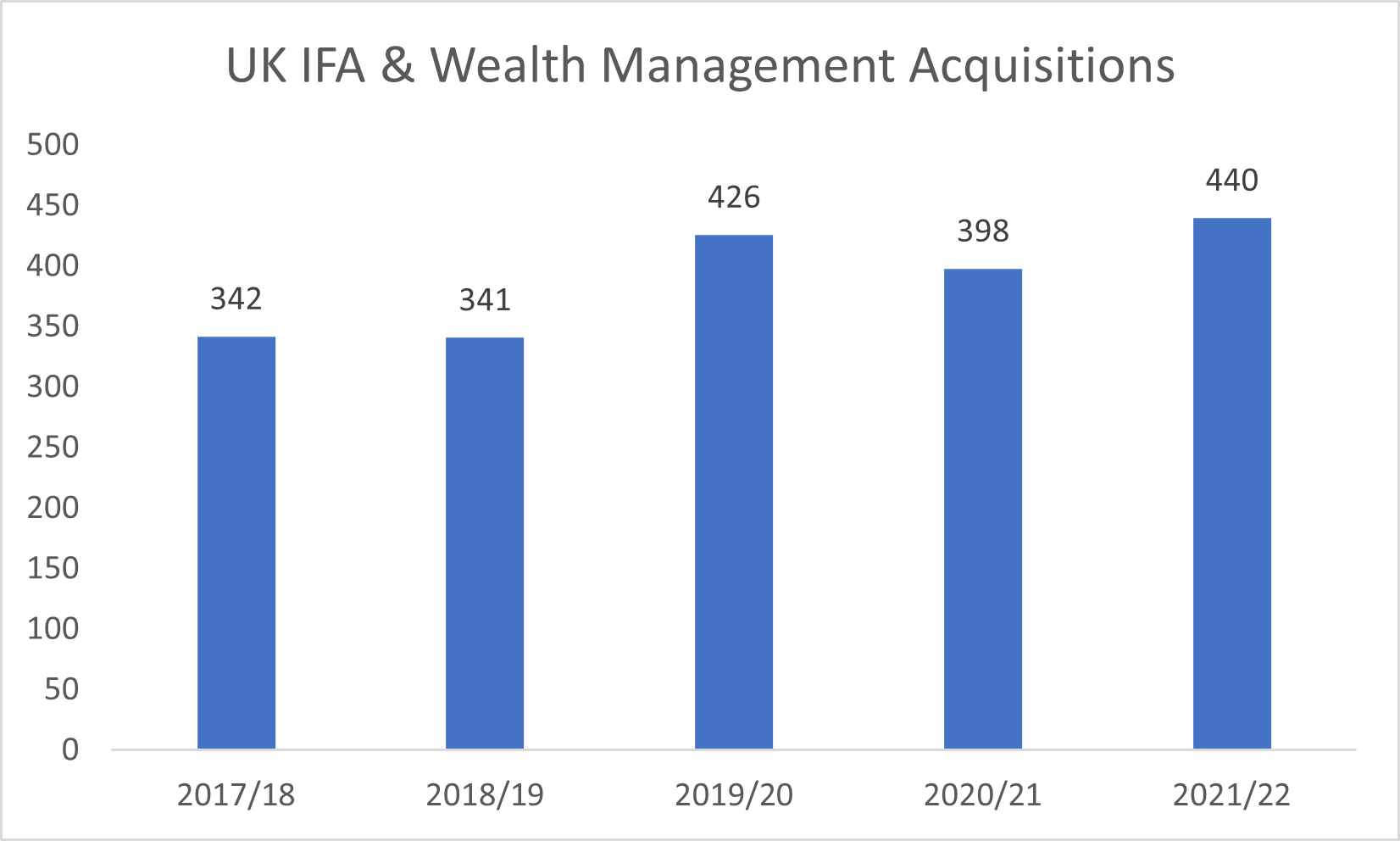

The FCA has released data showing that the number of IFA & wealth management businesses acquired in the UK over the past year has reached 440.

To most, the upward trend will come as no surprise, given the influx of new entrants looking to acquire, combined with turbulence in the markets and the regulatory pressures that firms across the sector are facing.

Source: FCA & Mayer Brown

Interestingly over the same period, the FCA shows that the number of financial advice firms operating in the space moved from 5,048 (2017) to 5,077 (2021).

It’s easy to see why acquirers in the space continue growing at the rate seen in recent years. Not only are the number of firms increasing, but the average revenue per firm is growing quickly.

According to RMAR (2021) data from the FCA, average revenues generated from retail investment businesses have grown by an average of 10.4% per year since 2017, exceeding £1m per firm for the first time in 2021. This average is of course skewed by the larger firms but serves as a useful benchmark.

Given the number of acquirers, or consolidators as they are often labelled, it would be interesting to be able to dissect the data and understand exactly who the buyers are and whether these transactions were successful.

Many go ahead under the radar and are not publicised which is why it’s difficult to analyse. But it would be fascinating to know how many of the newly created firms were previously authorised within a business that was acquired in recent history.

Several of the newer entrants seem to be following a well-trodden path of buying an advice business, forcing vertical integration, and capturing as much margin as possible.

I don’t think it’s a stretch to say that if advisers and staff are not properly incentivised to work with the acquirer or fundamentally disagree with the new business practices, they will vote with their feet.

If you are considering selling a business, the solution to this problem is to understand the track record of the potential buyer. How many transactions have been completed and over what timeframe? What did the businesses look like at purchase and what do they look like now?

The right fit for you will share this information gladly and you’ll have a group of sellers who can tell you if everything that was promised was received.

To find out more about how our unique acquisition model could work for you and your organisation, speak to a member of our M&A team today.

| Learn more | Contact our M&A team |